On Tuesday, Apple reported underwhelming results for the three-month period ended June 30, 2012. For the quarter, Apple reported revenue of $35.023 billion and earnings of $9.32 per share, representing 22.58% revenue growth and eps growth of 19.57%. The fiscal quarter's outcome, against expectations of much stronger growth, represents Apple's melancholy moment and a slow-growth period in a six-quarter era of exceptional growth that began with the first quarter of the current fiscal year.

Guidance and The Economy

For the current quarter, management offered conservative guidance of $34 billion in revenue and $7.65 in earnings per share. In the June quarter, all of Apple's major product lines, including the iPhone and the iPad, had unit sales results that were impacted by a challenging global economy, particularly in Europe. The iPhone's uninspiring 28% unit sales growth was also influenced by consumer expectations of a pending refresh of the product line.

Apple's quarterly results represent a static snapshot of a fast-moving company. As much as the June quarter results were a disappointment, the outcome reveals both challenges and opportunities in the fiscal quarters ahead.

Gross Margin

In the first six months of the current fiscal year, revenue growth zoomed forward at a 66% pace and earnings per share rose 104%. Apple's average gross margin during the six-month period was 45.9%. In the June quarter, gross margin dropped to 42.8% due to the impact of currency fluctuations, the lower price on the iPad 2 and a change in model mix on iPhone sales. Apple's gross margin moving forward may remain closer to the June quarter's outcome rather than return to the very high gross margin reported in the first two quarters of this fiscal year. Moderation in gross margin will move the rate of earnings per share growth closer to the rate of revenue growth in future quarters.

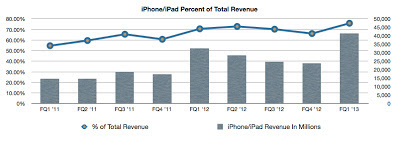

In the first six months of the current fiscal year, the iPhone represented 55% of Apple's revenue total and the popular iPhone 4S delivered very attractive gross margin. In the June quarter the iPhone represented just over 46% of revenue. The iPhone's smaller percentage contribution to the quarter's revenue total and the lower price on the iPad 2 lead to a sequential drop in gross margin from 47.37% to 42.8%. Although the successor to the iPhone 4S will generate industry leading gross margin, the change in the company's overall revenue mix and anticipated higher costs for the new flagship handset will influence gross margin throughout Apple's next fiscal year.

Operating Expenses

Operating expenses, inclusive of stock-based compensation, remained under 10% of revenue in the June quarter. Operating expense discipline continues to positively impact the percentage of revenue that flows to the company's net income line. In the June quarter, about one-third of revenue flowed to the operating income line and about one-quarter of every revenue dollar landed on the net income line.

The iPhone Product Cycle

Throughout the conference call with analysts, management repeatedly mentioned the impact of consumer expectations of an imminent iPhone product line refresh on unit sales in the quarter. Consumers will, by the millions, postpone or delay iPhone purchases and iPhone handset upgrades in favor of waiting on the release of new models.

There are a number of factors that determine or influence the release dates for new iPhone handsets. These factors include production capacity, component supplies, planned releases of iOS updates and contracts with iPhone carriers. None of these factors are changed by consumer expectations for the release of a new iPhone.

At this time, all points lead to a fiscal first quarter (fourth calendar quarter) release of the successor to the iPhone 4S. The iPhone 4S will remain the company's flagship iPhone handset for about 12 full months. Very high rates of revenue growth will be realized in the first two quarters of next fiscal year due to the release of a new flagship iPhone and the expected lower prices on the iPhone 4 and iPhone 4S models. Between now and the release of a new iPhone handset, overall revenue growth will be held in moderation even with a strong September quarter for the Mac and iPad product lines.